How much profit should your business be making?

How much profit should you be making?

How much should you be paying yourself?

The Business Owner’s Guide To Finding Out – Introduction

How much profit should we be making, and how much should we be paying ourselves as business owners are two of the most internally pressing questions we tend to ask ourselves. In this post, we’re going to look at (and answer) both of those questions.

We rarely verbalise it, but we want to know the answers – as business owners and human beings there are a couple of traits that we carry with us…albeit subconsciously most of the time:

We’re curious: after all, you wanted to know what answers you would find in this blog post based on the title of the blog post

We’re competitive: we want to know how we are doing compared to our friends, acquaintances, business peers, our contemporaries and our competitors – in fact, just about business benchmark that we can find to compare our own performance to

We’re compassionate: we fundamentally know that our business (product or service based) has a need to serve its audience with a solution to their problem – essentially – we want to help (and make bank, of course ?)

Idea to develop {We forget however, to be compassionate with ourselves – we don’t pay ourselves enough for the time and effort – mental and physical – that we put into our businesses. Often, we’re too worried about looking after everyone else, and we tend to put ourselves last}

So what does all this mean then when it comes to finding out whether or not we are in fact paying ourselves enough, or making enough profit? How do we know if we’re leading the pack?

We go back to measuring two of the most primal indicators: profit and pay – how do they compare?

Make sure that you access the worksheet here to make it nice and easy to work out your answer.

Question 1: How much profit should we be making?

As is so often the case with such questions, the answer is…it depends…

However, the good news is that there is an answer for you and your business – it just depends upon the ‘size’ of your business. All that we need to answer the question more accurately is a suitable benchmark that will allow us to compare the relative performance of businesses of different ‘sizes’.

The benchmark that we use when we apply the Profit First method within a business is ‘Real Revenue’.

So what is ‘Real Revenue’? It is a term that we use in the Profit First system to show that ‘top line revenue’ is not truly representative of the ‘size’ of a business.

Your ‘Real Revenue’ is the revenue your firm generates when Materials and third party Sub-Contractors are excluded. This number is used to represent the ‘true’ income of a company, and the cash flow it actually manages and controls – Real Revenue is the real money that your business makes, therefore.

Real Revenue gives us a quick way to get all companies onto a level playing field so that we can make sensible comparisons between them.

Real Revenue – The Calculation

Here’s how we work out Real Revenue:

Total Income

Less: Materials Costs

Less: Sub-Contractor Costs

= Real Revenue

Idea to develop {Is Real Revenue the same as Gross Profit?}

When it comes to materials and sub-contractors, whilst you may make a margin, it isn’t the core driver of profitability (because you don’t really control it).

If you run a service based company, then it is quite possible that your Total Revenue figure is the same (or very close to) your Real Revenue figure. Note: when applying the Profit First system in a business, if Materials plus Sub-Contractors come to less than 20% of the Total Revenue of the business, then we normally class these costs as ‘Operating Expenses’ as they don’t make up a significant proportion of the costs of the business overall.

Real Revenue – An Example

Let’s start with an example of a building contractor firm, and assume that they have a $3,000,000 top line revenue (Total Income). They spend $1,000,000 on materials and a further $500,000 on sub-contracted labour in order to complete the projects that they are working on.

Taking the calculation above, that means that they are in fact a $1,500,000 Real Revenue firm according to the Profit First method ($3,000,000 – $1,000,000 – $500,000 = $1,500,000).

All that is really happening here is that there is $1,500,000 being moved around for other people and businesses – the building firm is just a conduit for moving money from the customer directly to the purchase of materials and the cost of sub-contractors.

So, before we can make a sensible judgement about what the profit level for your business should be, we need to know what the ‘Real Revenue’ of your business is first…

Jot down the numbers for your business in the table below: (or access the worksheet here)

| Total Revenue | $ / £ / € | ||

| Materials Costs | – | $ / £ / € | |

| Sub-Contractor Costs | – | $ / £ / € | |

| REAL REVENUE | = | $ / £ / € |

You should be able to find these numbers fairly easily from your own records (spreadsheets, or accounting/bookkeeping platform if you do your own bookkeeeping etc – if you are looking at your accounting system, you should find these numbers towards the top between the ‘Sales’ line and the ‘Gross Profit’ line), or you can ask your bookkeeper / accountant for them.

Remember, deduct only materials and sub-contractor costs from your ‘top line revenue’ number – if the materials and sub-contractor costs come to less than 20% of your top-line revenue (you may instinctively know this, ie you don’t use any ‘raw materials or third-party sub-contractors), then we’ll assume that your top line revenue is the same as your Real Revenue number (nice and easy!)

We’ll need your ‘Real Revenue’ number for later on…

You will also need your ‘Net Profit’ number later, so whilst you’re digging into your Profit & Loss Account, note this number down for later too (you should find this number right at the bottom of your Profit & Loss Account, or again, ask whoever does your bookkeeping / accounting for this number if you are unsure).

We need to know the ‘actual’ amount (number) for your Net Profit, and we need to calculate what that is as a percentage of your Real Revenue (Net Profit divided by Real Revenue).

| Net Profit | $ / £ / € | |

| Real Revenue (number calculated above) | $ / £ / € | |

|

Net Profit as a % of Real Revenue (divide Net Profit by Real Revenue) |

% |

Question 2: How much should you be paying yourself?

As a business grows, how a business owner ‘earns’ their money tends to change. Typically, the aim is to work less ‘in’ the business, and more ‘on’ the business.

As a result, the way in which a business owner is financially rewarded will also change through an increase in profit payments (dividends / distributions), and a relative decrease in the wages component.

So we need to work out what your Total Owner’s Pay is…

Jot down the following numbers in the table below: (or enter into the worksheet if you have already downloaded that – if not, you can access it here).

| Gross Salary | $ / £ / € | ||

| Dividend / Distribution | $ / £ / € | + | |

| Total Owner’s Pay | $ / £ / € | = |

Add your Gross Salary to the additional Dividends / Distributions you take to work out your ‘Total Owner’s Pay’

Now we need to work out what ‘Total Owner’s Pay’ is as a percentage of our ‘Real Revenue’ number (Total Owners Pay divided by Real Revenue)

|

Total Owner’s Pay as a % of Real Revenue (divide Total Owner’s Pay by Real Revenue) |

% |

So now we have 2 percentage figures noted down – one for our Net Profit, and one for our Owner’s Pay.

In order to complete the picture, there are 2 other components that Real Revenue must cater for:

Tax

Operating Expenses

They will make up the balance of the 100% allocation of Real Revenue in the tables below.

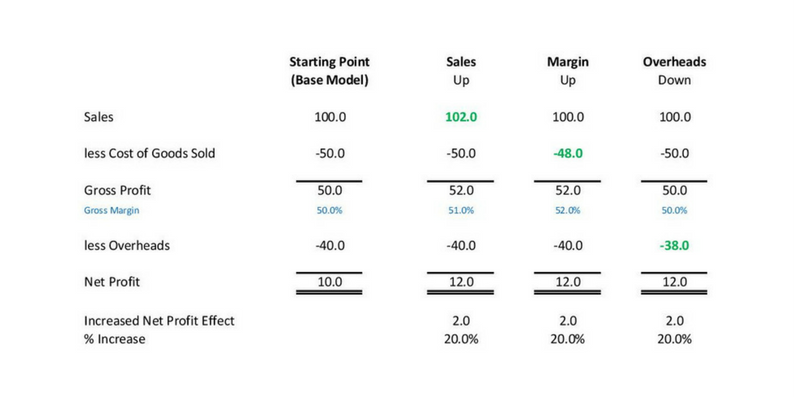

The tables below show the typical Real Revenue bandings – applied initially as Target Allocation Percentages according to the Real Revenue level of a business.

These percentages have been compiled over an extensive period of time, and are as a result of comprehensive research and analysis by Profit First, and have been found to be representative of companies that exhibit ‘healthy numbers’ at the various levels of Real Revenue range.

Let’s start with businesses that have a Real Revenue of below $1,000,000 (c£750-800,000):

| Real Revenue Range | $0 – $250k | $250 – $500K | $500k – $1M |

| Real Revenue % | 100% | 100% | 100% |

| Profit | 5% | 10% | 15% |

| Owner’s Pay | 50% | 35% | 20% |

| Tax + Operating Expenses | 45% | 55% | 65% |

Example:

For instance, let’s take a business that has a Real Revenue of $300,000 (so we will use the percentages from the middle column from the table above):

Our Profit should be: $300,000 x 10% = $30,000

Our Owner’s Pay should be $300,000 x 35% = $105,000

Let’s move onto businesses that have a Real Revenue of more than $1,000,000 (c£750-800,000):

| Real Revenue Range | $1 – $5M | $5 – $10M | $10 – $50M |

| Real Revenue % | 100% | 100% | 100% |

| Profit | 10% | 15% | 17% |

| Owner’s Pay | 10% | 5% | 3% |

| Tax + Operating Expenses | 80% | 80% | 80% |

Example:

For instance, let’s take a business that has a Real Revenue of $1,000,000 (so we will use the percentages from the left hand column above):

Our Profit should be: $1,000,000 x 10% = $100,000

Our Owner’s Pay should be $1,000,000 x 10% = $100,000

Bringing It All Together – Your Answers

Consequently, now that we have found out the answers to the questions above, we need to bring all that information together so that you can find out whether or not you business is making enough profit and whether or not you are paying yourself enough as the business owner relative to the Real Revenue size of your business.

| Real Revenue Range (for your business) | $/£/€ |

| ACTUAL Real Revenue (for your business) | $/£/€ |

| ACTUAL Net Profit (for your business) | $/£/€ | % |

| ACTUAL Total Owner’s Pay (for your business) | $/£/€ | % |

Now we need to enter the Profit % and Owner’s Pay % numbers from the table above into the second column in the table below,

AND

We need to add in the 2 percentage figures for Profit and Owner’s Pay from the Real Revenue Range Tables above (whichever range applies to your business) into the first column for the Target Real Revenue Range:

| Target Real Revenue Range % | Your Actual % | + / – % | |

| Real Revenue | 100% | 100% | |

| Profit | |||

| Owner’s Pay |

In conclusion:

How did your business measure up to the benchmark levels?

How far above (or below) the Target Real Revenue levels were you?

Let me know in the comments below!

This is normally the moment that people need to check in with their emotional state!

Feelings can range from elated, through ‘breathing sigh of relief’ to disappointed…

If you have beaten the benchmark figures and are feeling elated as a result of your answers – congratulations! – keep doing what you’re doing, but remember to keep a keen eye on those expenses though! Come and celebrate with me – schedule a call here to let me know!

If you are breathing a sigh of relief, then chances are you realise that your positive answer is more by luck than judgement – which is fine at this point (you are where you are, after all), but this is probably not going to sustain as the business grows further without a system in place that intentionally creates an environment for your business to generate the right levels of profit, and one that is capable of paying you your just reward as a business owner…so let’s build on the solid platform you have built – schedule a call with me here so that we can plan out how to sustain and improve upon your current position.

If you are feeling disappointed, then now is the time to take action and plot a new course when it comes to how money is managed and allocated within your business. As hard as it may seem at this point, we definitely need to talk about the situation in which you find yourself right now…take the action step that you need right now and book a call with me here and we can work out a plan to get you to where you want to be.

Hi there, I'm Jason!

As a Certified Profit First Professional Coach, I specialise in driving profit growth in ambitious entrepreneurial and owner managed businesses.

Profit is the commercial non-negotiable. I want to help you to create a more profitable business so that you have the freedom to make the choices that you want to make, to create the impact that you want your business to make - be that within the business, in terms of your own personal life satisfaction (and that of your management team & staff), and socially.

As a profit growth strategist and mentor, I help business owners get clarity over their finances - specifically as it affects their profitability. That means that we focus on getting intentional about improving business profitability with simple strategies.

Together we make sure that the business is baking profit into every sale, that business owners and stakeholders are able to receive a commensurate reward, that money is set aside for taxes (corporate and personal as appropriate) - and we create a buisness model that fits around those three priorities.

Learn more about the great work that we can do together here on the website

25+ years of commercial experience are blended into a hybrid mix of business growth coach, consultant and CFO, bring strategic and tactical support to businesses looking to transform their profitability.

I graduated with an Accounting & Finance degree, have been the Bookkeeper, Financial Controller, Financial Director, CFO & Commercial Director, Financial Strategist, Consultant, Coach and Business Mentor. That has covered business turnarounds, corporate SME/SMB growth, and external roles including being a registered business finance growth coach on the UK Government's 'Growth Accelerator' scheme.

What does that all mean for you?

Knowhow. And absolute dedication to the transformation of the profitability of your buisness.

So, make the decision to invest in your profitability and book your call here.

Hi there Profit Seeker, I’m Jason!

Hi there Profit Seeker, I’m Jason!

Recent comments