Mindset Shift & Business Money Mindset Improvement

BUSINESS MONEY MINDSET SHIFT

Part 2 of the series “6 Quick Ways to Improve Your Business Money Mindset”

In the first part of this business money mindset series, we looked at a couple of typically personal elements of where a mindset shift is often required.

Money mindset mastery is a key part of the puzzle when looking to create business success. Getting your mindset right when building wealth relies on you having both your business mindset and commercial mindset ‘in the zone’ and fully focused on the business growth non-negotiable of making profit. That means that for many of us, we need to embrace a mindset shift so that we feel comfortable with money.

Mindset issues we looked at in part 1 covered:

- Why we need a growth mindset to promote mindset development when it comes to addressing the financial needs of your business {PS – remember: your business relies on you}

- Why when we have a simple framework to work to, it is easy to create the mindset shift that we need when it comes to making a profit intentionally

- Why a positive mindset shift occurs when we realise that we don’t have to understand all of the numbers in our business, or how they were put together

Let’s now look into the next two business money mindset issues, and think about how we can create the mindset shift that is required.

Number 3: You and Your Business Money Mindset –

“Break. It. Down.”

Mindset issue number 3 is all about the feeling of being overwhelmed (which tends to create a negative mindset) by trying to answer a business finance question that is ‘too big’, but it seems like the right question to ask.

The question:

“How do I make more profit?”

Trying to answer a question that is ‘too big’ is generally indicative of not knowing where to start, and consequently not having a structured plan because you don’t know how to break down the ‘big question’. It presents itself effectively as not understanding the wider subject, which consequently leads to feelings of overwhelm (at least to some degree) and maybe even inadequacy (more negative mindset feelings). Sounds a lot like that ‘fixed mindset’, doesn’t it?

This then typically leads to inefficient and irrational behaviour which is generally followed by a negative feeling around the subject as a whole, which often manifests itself as “I don’t understand any of this”…and a deepening of a negative mindset ensues…

Self-recognition

Do you recognise any of those patterns and symptoms when thinking about finance in your business? If you do, you’re not alone – far from it. The upside however, is to remember that you have your own zone of genius too (positive mindset time) – by definition we have to accept that we can’t all be good at everything. There’s nothing wrong with not being a ‘numbers’ or ‘finance’ person first and foremost, but as the CEO in your business, we do need to get you into a positive mindset space and create the mindset shift around 2 things:

- That it is ok to not know everything about numbers (less pressure to be an expert in this area means a more positive business mindset overall)

- That you do need to take responsibility for knowing how to make a profit in your business (accepting the overall responsibility of being a CEO means an improved leadership mindset)

That just means having a framework that you can relate directly to the process of making a profit with ease and simplicity, ie a simple framework to depend upon in the first place {PS – I’ve lost count of the number of ‘freebie’ downloads I’ve taken in for a ‘formula for this’ or a ‘formula for that’ – some of which I have used, some of which I have adapted to suit me over time, and with experience – the point is we have to start somewhere and wilfully engage with the topic}.

So, let’s get back to that question – the one that all business owners and entrepreneurs feel compelled to answer day in, day out – “How do I make more profit?”

A quick task for you right now – stop reading and grab a piece of paper, or open Notes on your phone – whatever you have to hand, and jot down the first 3 to 5 things that come to mind for you when answering that question…

OK – got your list? Great… {You can post them in the comments below – I’d love to see what you came up with!}

Here’s the thing – every single person reading this who has written down or thought through a list will probably have a list that could be wildly different to the next person.

How Do I Make More Profit?

Here’s the reality:

There are a ton of ways to make more profit. The key is focusing on the right options that are in context for you and your business – and having a framework on which to focus on in the first place.

For those of you that did actually stop and write your list down (I know there’s plenty who will have ‘read ahead’ looking for the answer without doing the work ?), I suspect that you have written down what effectively amounts to ‘tactics’, ie ‘sell more widgets’, ‘spend less on office stationery’ etc.

It is also likely that everything that you have written down will be valid, have merit and be a part of a bigger plan – but as you can probably see from your list, it has more than likely been curated randomly – ie you wrote down the first things that came to mind, followed by the next thing and the next thing…and as a result, you have a pretty eclectic list with not much structure attached to it.

If that’s you, then know that you won’t be the only one! This has happened because you have tried to answer ‘the big question’ all in one go, and not focused in a more structured manner on some specific higher level strategic ideas, which can then be broken down into tactical actions – because you haven’t found a suitable structure to work against…yet (go grab that download here – it will get you started for sure).

To make the process more efficient therefore, we need to channel that energy and desire for growing profitability into some smaller building blocks to make the task:

- More manageable

- More focused

- More achievable (with less unnecessary effort, ie greater efficiency)

We need to focus on the right things that will actually make a difference, rather than trying to do #allthethings in the hope we’re doing the right things that will improve our profitability.

[ctt template=”11″ link=”z3TMY” via=”yes” ]We need to focus on the right things that will actually make a difference, rather than trying to do #allthethings in the hope we’re doing the right things that will improve our profitability.[/ctt]

Break It Down

Think about it like this – I’m sure you’ve heard this analogy before – “How do you eat an elephant?”

The answer…One bite at a time…

It is just the same with profit – how do you make more profit? By getting clear focus on the only 3 things that will ever influence your profitability – sales, margin and overhead.

I’ll repeat that for you:

- Sales

- Margin

- Overhead (Expenses)

Now we just need to apply the structured thinking around each element – create a separate strategy for each that is in context to how your business operates and functions, and then list the tactical actions that will help you to deliver the strategy. It’s no different to how you probably plan out your marketing campaigns, right? It’s just about applying that planning skill to a different business discipline.

Make sure you grab the download below, and you’ll see just how easy it is to create a more structured answer to the question “How do I make more profit?”

So, despite the fact that there are a *million* ways to make a bigger profit, you’ll see that the strategic principles that underpin the answer to the question can be boiled down into one simple concept which can be applied to any business (including yours, guaranteed), regardless of where the business is geographically based, whether it operates online or from premises, whether it is service or product based, and regardless of the size of the business – be that trying to get your first 6 figure year under your belt, or whether you’re aiming for 7 figures plus doesn’t matter – the framework is exactly the same and the technique can be applied in the same way.

Number 4: You and Your Business Money Mindset –

“The money in your business doesn’t belong to you”

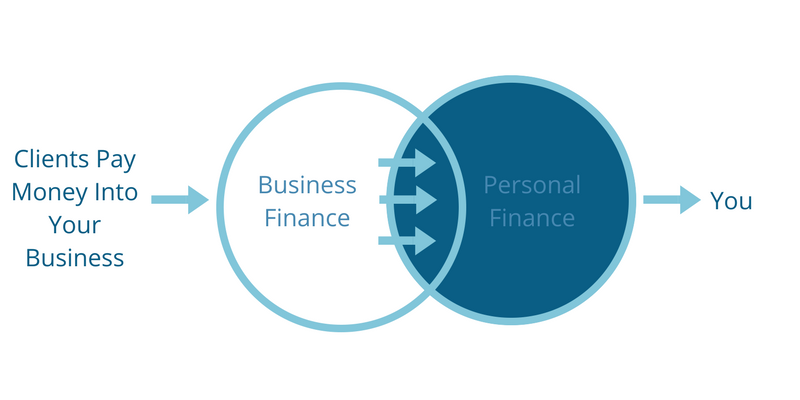

Business money mindset issue number 4 is all about the conflict between personal and business money, and why the money in your business doesn’t all belong to you…

So that’s a disappointment isn’t it – “The money in your business doesn’t belong to you”. Makes you wonder who you’re doing it for then really, doesn’t it…

Separate yourself from your business

Yes – you are doing it for you (and all of those great clients that you’re positively impacting of course), but the mindset shift that we need to create is one where you learn to separate yourself as a private individual from your business.

So, first and foremost:

The money in your business belongs to your business. You need to detach yourself from it, and yet create a bridge to it.

[ctt template=”11″ link=”gbjt1″ via=”yes” ]The money in your business belongs to your business[/ctt]

Sounds obvious, I know – but this is likely to be a mindset shift for anyone in the early stages of their business, or who has been carrying on a side-hustle alongside their regular job where it was ‘all just money going into the pot’. The original objective may have been just to ‘earn something extra’ to clear down personal debt for example.

This may also be a mindset shift for anyone who is growing a business where there has always been ‘sufficient cash’ to draw upon up to this point, but now the business is consuming cash as it grows – this just means that we have to start acting more like business owners looking for capital growth, not just looking for short term income.

Think bigger

If you’re struggling with that idea, think about what it would be like if your business was 100 times bigger than it is now – you’d be thinking about the business, not yourself, wouldn’t you? Mindset development relies on being able to detach ourselves from what is right in front of us and apply a new mindset approach.

Positive mindset time – you need to take that mental leap now…

- So, the tip here is to start thinking bigger about your business – stop thinking about your business servicing your own personal financial needs.

- Get the big picture right, [ctt template=”11″ link=”CTni4″ via=”yes” ]Focus on building a business where you are intentional about the level of profitability that you want, and the personal side of finance will look after itself[/ctt]

The Business comes before You

Thinking about your business as being a personal income generating machine is clouding your judgement (you’re thinking about it like an individual income, not like a business #realtalk), and the emphasis is on the wrong place and on the wrong things. Business success relies on creating a profitable business model first and foremost – then look to that to provide you with your income, not the other way around. That’s mindset development in action – putting your business before yourself.

When you start out as a new business owner, it’s all about ‘earning the income’ for sure and covering your essential personal costs – rent / mortgage / food / car etc. Maybe you left a corporate job and you know you used to maintain a lifestyle based on a salary – and you’re understandably desperate to cover that off as soon as possible again. It is no coincidence that the ‘first financial aim’ for most people as they set off into the entrepreneurial world is to earn their corporate salary working for themselves. It’s good for the soul and a positive mindset after all – validates the reason you left, doesn’t it?

You knew you had it in you to make more for yourself in money terms, rather than just making more for everyone else. The ‘salary matching mindset’ will only get you so far though because it represents a personal mindset, not a business mindset in operation because you’re still thinking about it as if all the money belongs to you.

You need to transition to a more commercial mindset with far bigger goals than that – you will necessarily incur additional expenses as you grow and you need to allow for that so get that into your business mindset now, because it will stand you in great stead in time.

Why the money doesn’t belong to you

Even if you are just starting out on your entrepreneurial journey, it is important that understand why the money doesn’t all belong to you – there are a couple of simple categories to consider here, dependent upon whether your business is service or product based, and ultimately what your overall business model looks like:

They can be summarised as:

- Direct Costs (also referred to as ‘Cost of Goods Sold’)

- Expenses (also referred to as ‘overheads’)

- Taxes

In all of the above instances, when you get paid by your client, you are effectively collecting money on behalf of your suppliers, labour force (employed or sub-contracted) and the tax collecting authorities. You may not have to pay these people immediately, and so the money may well sit in your bank account for a while – that doesn’t mean the money belongs to you, you are just the temporary guardian of it for all of those other people.

Disappointing I know…but that’s running a business for you.

The irony of it all if you have now left the corporate world behind? You’re now an employee within your own business…

Action points:

- transition from an ‘it’s my money’ style mindset to ‘my business generates money…and I have to ask my business to pay me for what I bring to it’ style mindset. In this respect, you work for your business, not the other way around.

- Be accountable to yourself – [ctt template=”11″ link=”u9tFR” via=”yes” ]Make such a success of your business in profit terms that you never have to think about your personal financial circumstances ever again[/ctt]

- Create a ‘flow’ of money from your business to you in a structured way – the flow derives from money entering the business first, and the business then releasing money to you. You need to see this as two separate transactions, not just one where the money your client pays comes straight to you.

If you look after yourself first, then your business will suffer or more than likely, fail to grow – at the very least you will starve it of the working capital that it needs to be nurtured and positioned for growth. Give it the best opportunity to grow – don’t starve it. Work it hard to make sure that you don’t starve yourself!

Business finance and personal finance are undoubtedly linked, but it is important that you understand that money belongs to your business first now – then you can take your share. Focus hard on the profitability of your business first, do the work, and the personal financial side of things will take care of itself.

Here’s A Download Link to help you with the simple profitability system details –

The #profitlevers system – how to an earn an efficient profit, simply: http://bit.ly/improveprofitabilityweb

Related Articles:

Here’s to focusing on business money mindset mastery!

Jason

Hi there Profit Seeker, I’m Jason!

Hi there Profit Seeker, I’m Jason!

I help online entrepreneurs and owner managed brick & mortar companies to build profitable businesses through the application of easy to understand business strategies.

I show you how to apply and implement the strategies, take the ‘fear’ out of the numbers and help you to become more confident about the financial aspects of your business that you really need to know about.

That means less stress for you so that you can focus on making the impact that you want to make with your clients and customers, safe in the knowledge that you know how to make your business more profitable for ever more.

You can run a very profitable business with ease and simplicity. I’m here to help you make it happen and keep you accountable to your goals, providing commercial and financial support and advice to help you on your way.

Learn more about the great work we can do together here:

Or you can book a call here:

https://jasonawithers.com/schedule-a-call/

Recent comments