Business Money Mindset Improvement (Part 1)

6 QUICK WAYS TO IMPROVE YOUR BUSINESS MONEY MINDSET – Part 1

Business money mindset mastery is a key part of the puzzle when looking to create business success. Getting your mindset right when building wealth relies on you having both your business mindset and commercial mindset ‘in the zone’ and fully focused on the business growth non-negotiable of making profit. That means you need to feel comfortable with money and create an ‘abundance mindset’. It is all too common for many new entrepreneurs to suffer from a ‘scarcity’ or ‘lack’ mindset’ – maybe that’s you right now? In this two part series, we’re going to look at 6 ways that we can become more comfortable around money and the business of making profit – and enjoying it with confidence and ease.

Mindset definition

Let’s start by defining what we mean by ‘mindset’ here:

Carol Dweck (Professor of Psychology at Stanford University), noted that she perceived two categories of mindset that allowed grouping of individuals according to their behaviour, especially in relation to how they handled failure:

- Fixed Mindset – abilities are believed innate and failure associated with belief that failure is associated with a lack of necessary abilities

- Growth Mindset – provided an individual invests study or effort, individuals believe that they can acquire any given ability.

Dweck contended that those living and operating with a growth mindset, will tend to live a less stressful and more successful life.

All of our discussion points below in both this blog, and the second part are predicated on a fundamental belief in the necessity to adopt Dweck’s ‘Growth Mindset’ in the entrepreneurial world of the business owner.

Number 1: You and Your Business Money Mindset

This introductory mindset issue is all about you – the 4th #profitlever (You’ll hear more about #profitlevers 1 to 3 shortly). You are the key to success that you are looking for. Sounds obvious doesn’t it?

[ctt template=”11″ link=”1H3N4″ via=”yes” ]You are the key to the success you’re looking for.[/ctt]

When it comes to running a successful business as business owners and entrepreneurs we feel the day to day pressure of feeling that we need to be good at everything. Some business disciplines we feel more confident about – marketing or sales for example, and this may well relate to our past business experience or training. It is not very often however, that we come into business feeling assured about the ‘money’ side of it, the ‘business finance’ piece (that’s why we have an accountant, right?).

Consequently we can tend to feel:

- Inadequate when it comes to discussing money

- Stressed about going to see our accountant (often accompanied by a feeling of inferiority)

- Unsure of what we need to do when it comes to working out how to make more profit

So here’s what we need to help with the mindset shift:

- A simple to understand framework to help us understand how to make an efficient profit

Imagine how that would ease a large part of our negative mindset about money – actually having a framework to work to! A simple way to understand how to make more money becomes a confidence based mindset shift that you can benefit from quickly.

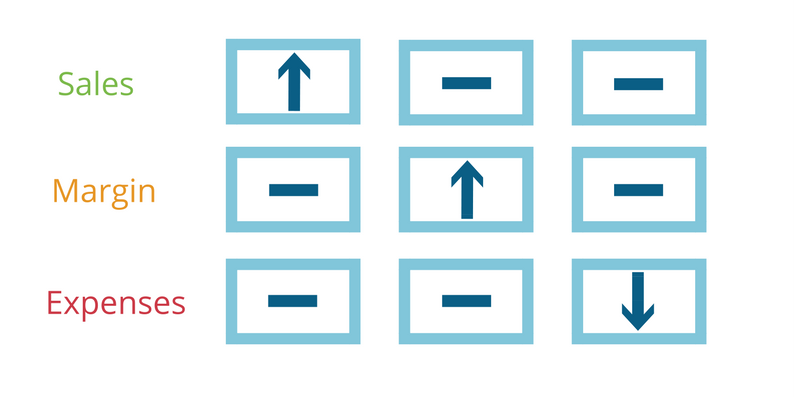

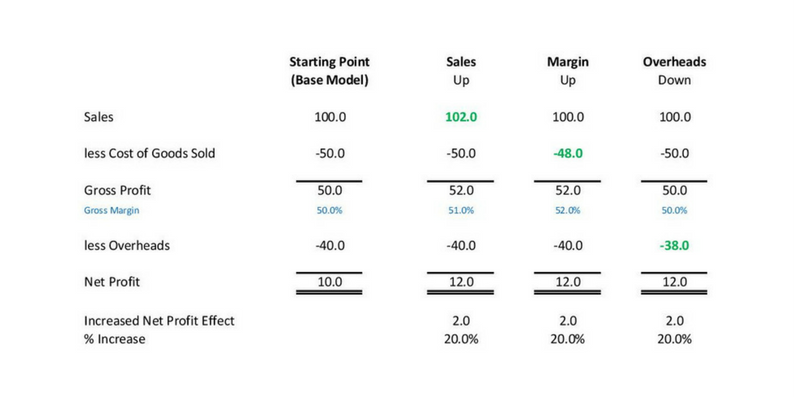

So let’s get back to those first 3 #profitlevers:

They are the cornerstones of the super simple to understand technique about how to improve profitability in your business that I use – indeed they are the ONLY 3 things that will ever help you grow your bottom line – you can find out about them from the download link below this post (or grab the download here), and get started working on those straight away. The framework has been specifically created in a way to help ‘non-financial’ business owners develop a stronger money mindset whilst encouraging personal growth in a probably unfamiliar financial world.

[ctt template=”11″ link=”5dp8r” via=”yes” ]The framework has been specifically created in a way to help ‘non-financial’ business owners develop a stronger money mindset whilst encouraging personal growth in a probably unfamiliar financial world. [/ctt]

But why are you the ‘4th #profitlever’?

Because the other 3 won’t be effective all on their own – they need you to take action and focus on each one strategically – the profit producing magic won’t happen without you! {No such thing as a free lunch!}

The process for making an efficient profit is simple, but it cannot work without any input or direction from you. Mindset development requires continual (re)affirmation – and it takes inner strength. But I know that you have that inner strength as an entrepreneurial business owner – you wouldn’t be where you are right now if you weren’t.

Believe In Yourself

You have to believe in yourself first and foremost, just like you believe in your business. Your business money mindset is a skill to be developed, just like your business will develop (and just like you have learned and developed other new skills already in your entrepreneurial journey so far):

- Your business money mindset and business both need pushing – by you

- Your business money mindset and business both need nurture and care – from you

- Your business money mindset and business both need regular attention – as they are both part of you.

So you’re the 4th #profitlever – you have to do the work – you know this as an entrepreneur and business owner – you need to take action, because no-one else will do it for you.

Make the personal commitment to yourself now – if you are to create profit with ease, and consequently earn more money – don’t move on until you acknowledge and embrace the idea that your future profitability and financial success all hinges upon you taking action and developing your business money mindset. Strength and belief from within is required.

Take the action now so that you can control and be laser focused about how to make profit in your business in the most efficient way possible.

Based on the actions that you have taken to date, you are exactly where you are meant to be. Now it is time to step it up a level and commit to a new future in your business with a new mindset around money.

Remember though – there is a support network available to meet you half-way, and more than willing to do so when you are committed to your path of growth and change.

But it has to start with YOU!

Number 2: You and Your Business Money Mindset –

“I’m not a numbers person”

This second business money mindset issue is all about the temptation to hide behind the phrase “I’m not a numbers person” as a reason for avoiding our business finances…and yet we still see ourselves as the CEO of our business despite the fact that we are turning a blind eye to one of the most fundamental of business disciplines.

So we need to start with the myth itself – “I’m not a numbers person”:

It manifests itself with thoughts about ‘not being good at maths’, and the internal diversion and excuse of ‘my accountant does that’.

Let’s get this straight – you don’t need to be good at maths. When it come to the business of making profit, you just need to be able to grasp a simple concept and apply it to your business (grab the download here or at the end of this post which will explain it).

What are you looking for in your ‘numbers’?

As a business owner you are looking for a couple for things from your business numbers – insights and impact. That doesn’t mean you need to know ‘how to put them together’. This is business money mindset development in action – understanding that it is not your job to know everything about bookkeeping and accounting technicalities.

[ctt template=”11″ link=”1QN10″ via=”yes” ]As a business owner you are looking for a couple for things from your business numbers – insights and impact. That doesn’t mean you need to know ‘how to put them together’. [/ctt]

Think about it this way:

If you’re in the online entrepreneur space, I bet you’ve managed to work out a bunch of things on social media over the last couple of years (including aspects of the tech) from a standing start – maybe even designed and built your own website along the way.

If you have managed to do that, you can apply that positive mindset to learning what you need to know to take control of profit in your business. Not only that – I can pretty much guarantee that you know more than you actually think you do already – just because you don’t use the same language as your accountant doesn’t mean you don’t know anything. You are just running more on ‘instinct’ at the moment (you’re just missing a reliable framework to help you focus on the right things – check out the download below (or here) for more on that).

So now it’s tough love time:

You may not think of yourself as being a ’numbers person’, but you are a business owner, be that online entrepreneur or brick and mortar based – and the reality is that numbers are going to be an inevitable part of your future, for better or worse. So the key to success is money mindset development (see point 1 above).

Being a CEO

So let me ask you this:

Do you think that the CEO in a corporate is the best sales person, marketer, financial person, people person, production guru or organiser? No – of course they’re not. They may well have a background and a bias towards one core business discipline, and they well be more well versed in the depth of one subject compared to another.

But, here ‘s the thing though for those CEO’s who aren’t ‘numbers people’ first and foremost – they can’t avoid the numbers – they need processes and systems in place to make sure they get the numbers that they do need, and learn to utilise those numbers. That doesn’t mean they need to understand ALL the numbers – they just need to understand the parts that they need to drive profitability in their business.

The myth re-visited

So let’s return to the myth, and I’m going to flip it on myself for you:

Just as you don’t have to be a numbers person first and foremost – likewise, for myself, it doesn’t mean I get to avoid ‘everything marketing’.

Take for example the following:

Do I understand everything about pixels, re-targeting, SEO, video production and copywriting? Of course not – my ‘zone of genius’ lies elsewhere, but I’m not hiding from these things.

Do I have an open mind and a positive mindset when it comes to embracing the overall discipline of marketing in my business? It’s a non-negotiable for me – it is required in order to progress. Have I been and am I spending money on improving my skills – definitely.

Am I prepared to work on mindset development in this area of business. You bet! Because I know it forms part of my future and I can’t afford to ignore it.

It’s just the same for you, but the inverse scenario I suspect between finance and marketing – it is more a question of committing to the mindset shift of being prepared to understand the most important part of running a business – the business non-negotiable of making a profit.

Now you don’t need to know how to do all of the technical accounting and bookkeeping things to know how to make a profit. Your mindset development task here is to commit to understanding the concept behind 2 simple images – neither of which contains a single number! {PS – I bet your accountant has never told you that was possible!}

8 words show you all you need to grasp, and I know that if you’re running your own business, you can definitely handle 8 words that will set the profitability path for you for evermore. Your business success is built on this principle – develop your mindset to let the concept in. Remember that ‘growth mindset’ definition in the introduction? This is the time for it.

You can find the link to those 2 images and the concept behind them in the link below this post or right here.

Like most things in business life, the key is taking action. It is also about taking responsibility. So you can decide to either carry on as you are thinking that you’re not a ‘numbers person’ (‘fixed mindset’) or you can take responsibility as the CEO in your business and open your mind to receiving the knowledge that improving your profitability starts with the simplest of concepts and 8 words (and by the way, one of them is repeated, so it’s only really 7 words…easier already, you see….)

Business money mindset mastery says that insight and impact in your business numbers may come to you in a more comfortable format than you think. It is your job as the CEO in your business to find the number interpretations that make sense to you (you can talk to your bookkeeper or accountant about this, or book a call in with me below if you’d like some help with this) – that may not be a table of data in a spreadsheet – a graph can tell a simple numbers story too…you want to make more money? Develop your business mindset to create space for money mindset development too then.

Business Money Mindset Improvement – Conclusion (Part 1)

In part 1 of this business money mindset series we identified three mindset issues that that can hold us back in our search for greater business success and our desire to earn more money. We have seen that this is largely due to not having:

- perceived depth of experience when it comes to business finance (remember though – you know more than you think already!)

- a perception that we have to know everything about our numbers (including bookkeeping and accounting technicalities)

We have seen that fundamentally we need to be prepared to adopt more of a ‘growth mindset’ across all business disciplines. We have to start the mindset development work in order to take responsibility more fully for our businesses overall (as CEO’s, that is our job!).

I’d love to know which of the business money mindset issues you feel you identify with the most and why in the comments below:

- Is it about the need to engage more fully across all business disciplines?

- Is it about a ‘fear of numbers’ generally?

- Is it about not having a clear plan for understanding how to make a more efficient profit?

I’m here to support you through that journey, but remember it has to start with you. If you’re prepared to start addressing these things, I’m prepared to meet you more than half-way to help you conquer the issue ?

- Click here to sign up to make sure you receive future posts about how to make your business more profitable.

In parts 2 and 3 of this business money mindset series, we’ll be looking at:

- Why the money in your business doesn’t belong to you…yet

- How ‘Profit Gives You Choices’

- Why we need to be deliberate about the profit that we (want to) make

Here’s the Download Link –

The #profitlevers system – how to an earn an efficient profit, simply: http://bit.ly/improveprofitabilityweb

Related Article:

Here’s to focusing on business money mindset mastery!

Jason

Hi there Profit Seeker, I’m Jason!

Hi there Profit Seeker, I’m Jason!

I help online entrepreneurs and owner managed brick & mortar companies to build profitable businesses through the application of easy to understand business strategies.

I show you how to apply and implement the strategies, take the ‘fear’ out of the numbers and help you to become more confident about the financial aspects of your business that you really need to know about.

That means less stress for you so that you can focus on making the impact that you want to make with your clients and customers, safe in the knowledge that you know how to make your business more profitable for ever more.

You can run a very profitable business with ease and simplicity. I’m here to help you make it happen and keep you accountable to your goals, providing commercial and financial support and advice to help you on your way.

Learn more about the great work we can do together here:

Or you can book a call here:

Recent comments